RISK MANAGEMENT AND MANAGERIAL INCENTIVES

Firms whose managers are also shareholders (meaning that they also benefit from the firm’s profits) are apparently the most diversified. Tufano (1996) tested this premise for firms in the gold mining industry. He found that managers who have a large portion of their human capital and compensation invested within their firm wish to protect themselves more. Attributing firm equity to managers is beneficial when it comes to risk management, yet this incentive is often more costly than stock options.

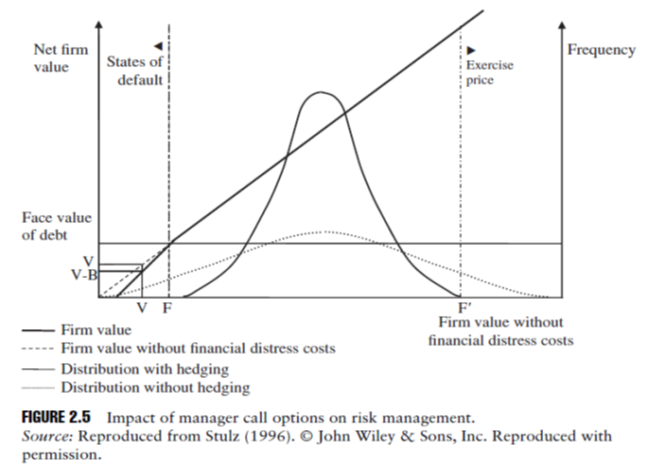

In addition, Figure 2.5 (Stulz, 1996) explains why firms that compensate managers with stock options may engage in more speculation or may be more lax with respect to risk management. Managers who hold stock options with a strike price equal to F′ are less inclined to hedge because hedging decreases the volatility of the firm’s shares (which consequently decreases the value of the stock options) as well as the probability of undertaking personal projects after having exercised the options. The darker density corresponds to a null default probability (to the right of F), but also to a null probability of exercising the managers’ stock options (to the left of F′), hence the conflict of interest between managers and shareholders. Given that managers hold stock options, they may prefer the dotted density function, whereas shareholders may prefer the darker density function. As we will see later, this potential conflict of interest will be more significant when options are out-of-the-money.

References:

- Dionne, Georges, 2019, Corporate Risk Management: theories and applications, Wiley, ISBN 9781119583172 (Epdf)

- Stulz, R.M., 1996. “Rethinking Risk Management.” Journal of Applied Corporate Finance 9, 8–24.

- Stulz, R.M., 2003. Risk Management and Derivatives. Thomson/South-Western.

Image Sources: Google Images